Downcoding happens when the insurance payer processes a claim at a lower level than what was billed. In other words, you provide a service, code it correctly, but the payer reduces reimbursement to a less complex, or lower level code. This means you aren’t getting paid what you’re owed. And, for eyecare practices, this can quietly chip away at revenue and distort your financial picture.

Aetna and Cigna are two that have added to their policy (effective 10/01/2025) new Evaluation & Management (E/M) reimbursement policies that could directly reduce payment for higher-level visits. These changes focus on downcoding Level 4 and 5 E/M services if the submitted documentation doesn’t fully support the reported complexity or time. We fully expect other payers to follow the same policies in due time.

Why Is This Happening?

There are a few common drivers of downcoding:

- Incomplete or vague diagnosis codes: Using unspecified codes instead of precise ICD-10 codes.

- Documentation gaps: When the medical record doesn’t fully support the level of service billed.

- Payer algorithms: Automated systems that downgrade claims if documentation or coding (CPT/ICD10) seems unclear or are with certain diagnosis.

The AOA points out that practices are especially vulnerable when laterality, specificity, or medical necessity aren’t clearly documented. If your documentation doesn’t meet their criteria, Cigna will reduce the service by one level (e.g., 99215 ↓ 99214, or 99214 ↓ 99213).

How to Identify It in Your Practice

You may have a downcoding issue if:

- Your reimbursement rate seems lower than expected for certain services.

- EOBs/ERAs show the claim paid at a lower level than submitted.

- You notice frequent use of “unspecified” diagnosis codes in your billing.

- Providers and billers aren’t consistently cross-checking coding with documentation.

- Regularly reviewing your claim file, the EOBs/ERAs, denials, and coding trends can help spot patterns before revenue loss adds up.

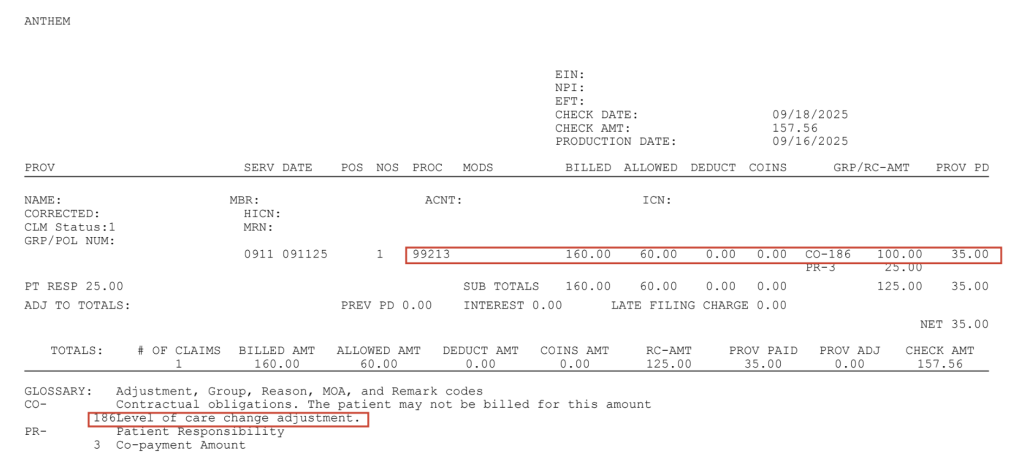

Below are some of the remark codes extracted from sample claims and payments:

- CO150: Payer deems the information submitted does not support this level of service.

- M85: Subjected to review of physician evaluation and management services.

- N610 Alert: Payment based on appropriate level of care.

- CO 186: Level of care change adjustment.

A careful review of the remittance advice will typically reveal downcoded claims, but some payers may downcode without providing notification of the adjustment. In addition to scrutinizing payer adjustment codes in the remittance advice, staff will need to review payment details, comparing the payment for each billed CPT code to the anticipated amount. See the example below of an EOB with downcoding applied (remark CO 186) and the claim that was filed.

How to Fix It (and Prevent It)

The good news? Downcoding is correctable and preventable with the right RCM processes:

- Be specific with diagnosis codes: Use the most detailed ICD-10 codes available (e.g., laterality, severity).

- Train providers and staff: Make sure your team understands how coding links directly to reimbursement.

- Monitor remittance documents: Audit regularly to identify payment reductions. For instance, some sources report that payers do not send separate notifications when a claim is downcoded.

- Work with experts: Partnering with an RCM team provides the expertise needed to ensure claims are filed accurately and denials/downcoding are worked quickly.

- Provider documentation: Ensure your documentation clearly provides the necessary details for services billed.

- Review payer contracts: Payers are including downcoding provisions in their physician communications, contracts, and policies.

- Make time for appeals: Payers are using software to downcode, meaning a human has not reviewed the claim. Also, they usually have not received the medical records for review at this point so always appeal the claim and payment.

- Medical record documentation: Ensure your record documentation meets the requirements to properly support the CPT code chosen and billed (CPT codes 92xxx or 99xxx). The AMA Rubric outlines the key elements of the E&M codes and how to properly choose the level based on diagnosis being treated.

Downcoding might seem like just another payer headache, but left unchecked, it drains revenue you’ve rightfully earned. If you’ve noticed lower-than-expected reimbursements or confusing coding denials, it may be time for a closer look.

Downcoding can go unnoticed for months. Let OMS give your billing and coding processes a health check so you can feel confident you’re getting paid what you’ve earned. From working with our clients we have the experience to quickly review your records and help pinpoint subtle documentation gaps to systemic coding errors. Reach out to Jerry at jgodwin@optmedsol.com or 210.585.2113 to get started.